Tech Census 2023: Looking at the State of Dental Technology Today

The results of Dental Products Report 2023 Tech Census are in, with answers giving insight into what dental professionals are using in today’s practice.

Tech Census 2023: Looking at the State of Dental Technology Today. Image: © Yellow Duck - stock.adobe.com

Every year, Dental Products Report® reaches out to dental professionals across the United States to get a good idea of just what technologies are most important to working clinicians today. With direct, from-the-source feedback, the Dental Products Report 2023 Tech Census provided insight on just what technologies dental professionals use the most, the ones they’re most looking forward to using in the future, and what they’ve chosen to leave behind in the past.

There was a total of 121 respondents, and answers were rounded up or down to the nearest whole number. Demographically, more than half of respondents are dental practice owners with more than 20 years of experience in the dental profession. More than half are solo general practitioners, while around 30% of respondents are at single-office, multiple-doctor general practices.

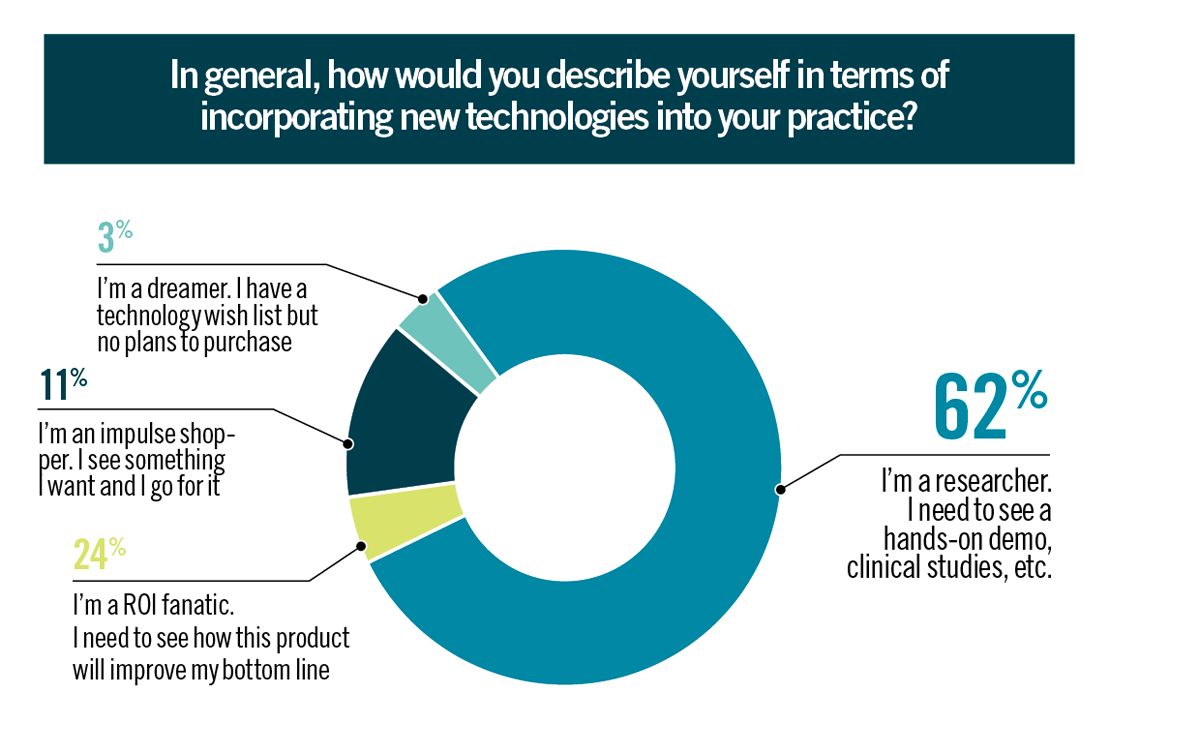

Graph 1

[ Research Remains King ]

More than half the respondents said research is most important when considering a new technology for the dental practice. This may be comforting for patients, knowing that their dental professional did their homework to determine what best fits their dental practice. This is a bit of a bump up from 2022’s results, where 56% of respondents claimed research as being the most important factor.

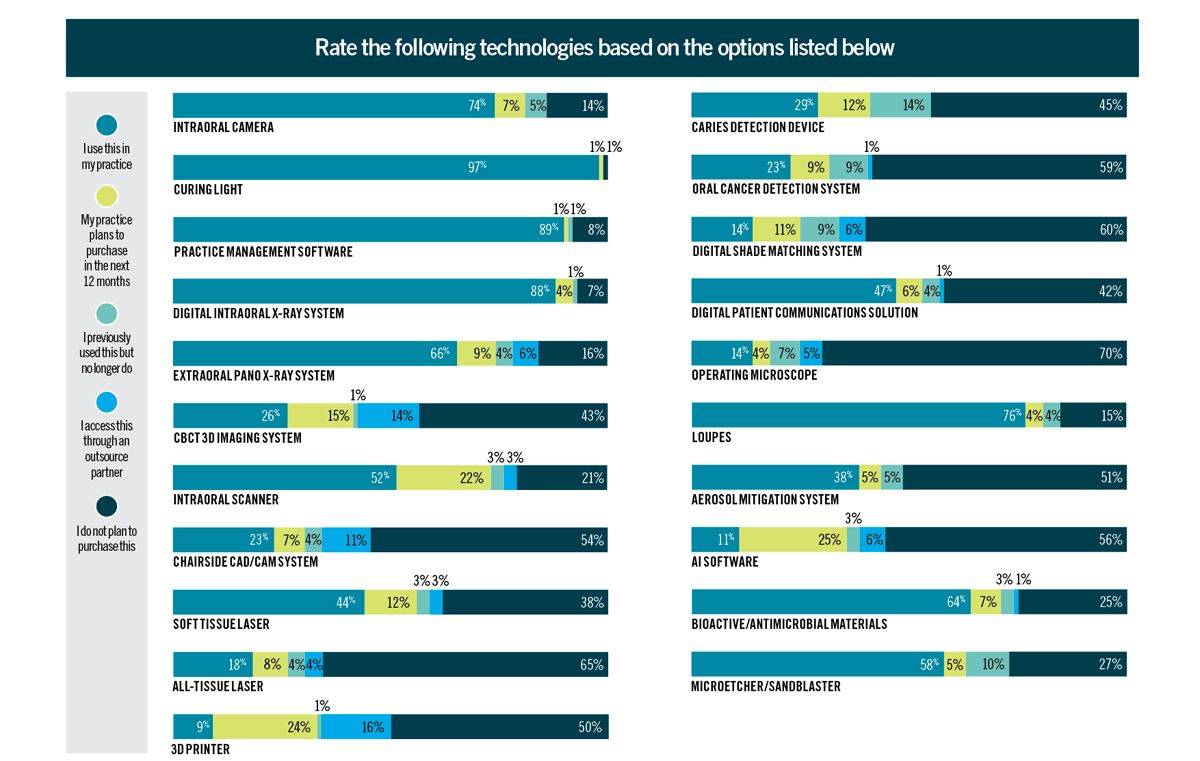

Graph 2

[Back to the Classics]

According to this year’s survey, dental professionals are still most confident in owning familiar technologies such as curing lights, practice management software, intraoral x-ray systems, and more. Emerging technologies such as artificial intelligence (AI) are still met with some resistance; however, plans may change, as 25% of respondents said they will purchase such technologies eventually. This is in stark contrast with 2022’s results, which indicated that only 9% of respondents would purchase AI software within the next year.

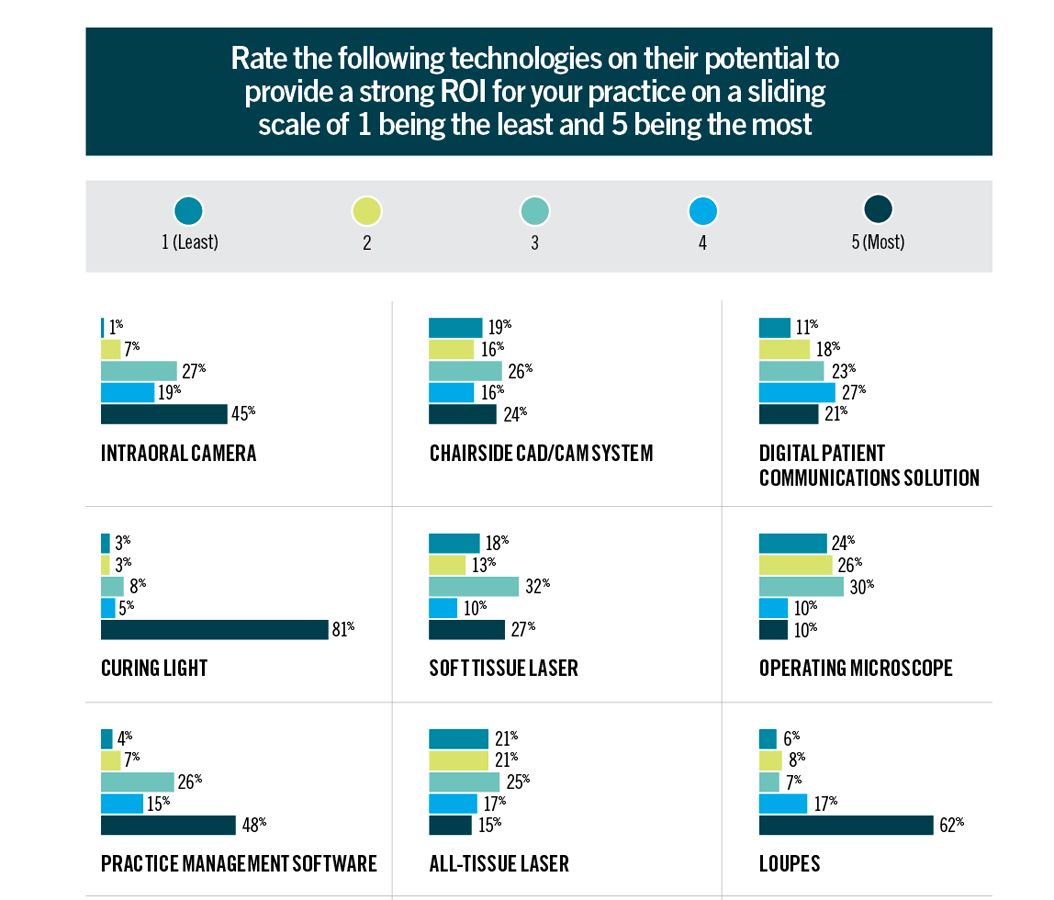

Graph 3

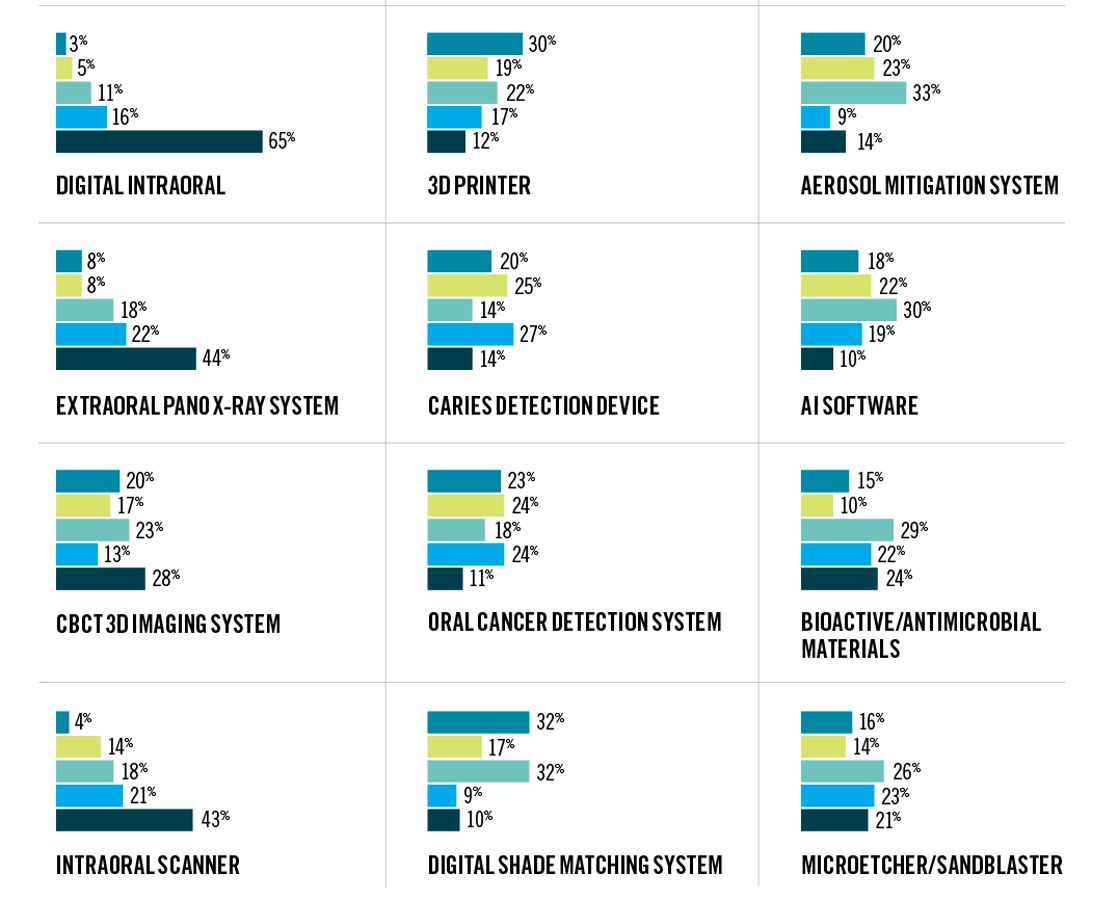

Graph 3.1

[Money Matters]

Considering a practice’s return on investment (ROI) is important to dental professionals, with 24% of respondents saying that ROI was a deciding factor for them. According to respondents, the technology with the smallest ROI was the same as that of 2022—a digital shade-matching system. Popular technologies in this category included curing lights and digital intraoral x-ray systems.

Graph 4

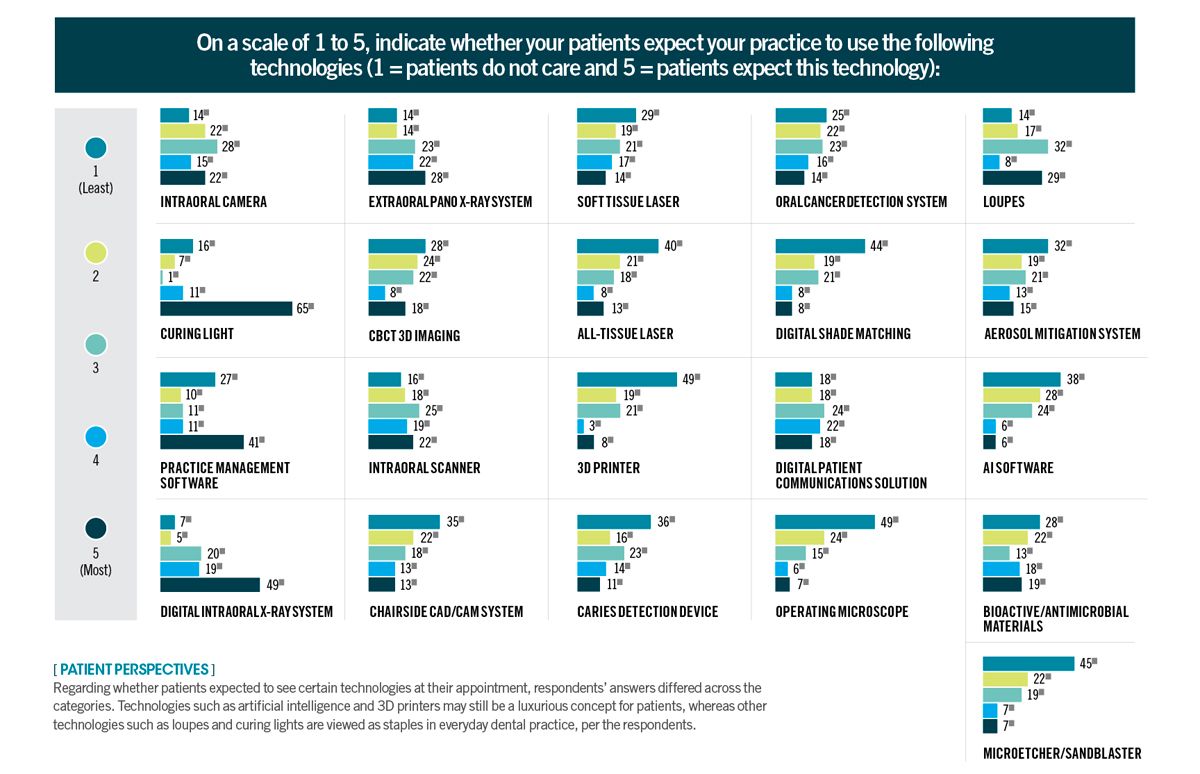

[ Patient Perspectives]

Regarding whether patients expected to see certain technologies at their appointment, respondents’ answers differed across the categories. Technologies such as artificial intelligence and 3D printers may still be a luxurious concept for patients, whereas other technologies such as loupes and curing lights are viewed as staples in everyday dental practice, per the respondents.

Graph 5

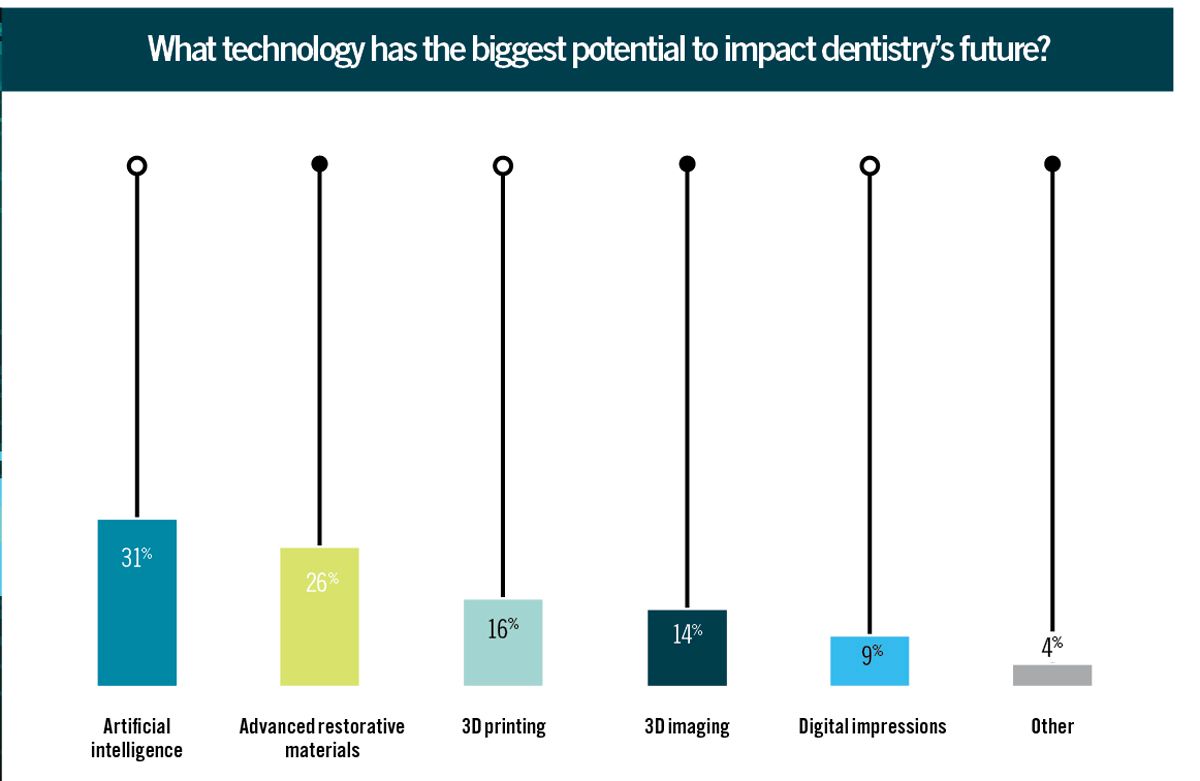

[ The Future is Now]

A technology that stands out in each response is artificial intelligence. This quickly growing technology has permeated other markets, so it stands to reason that its steps into dentistry are already taking place, and care may be improving because of it. Respondents also agreed that advanced restorative materials are primed to affect dentistry’s future, especially as the biology and science behind these materials is more widely researched and understood.

Graph 6

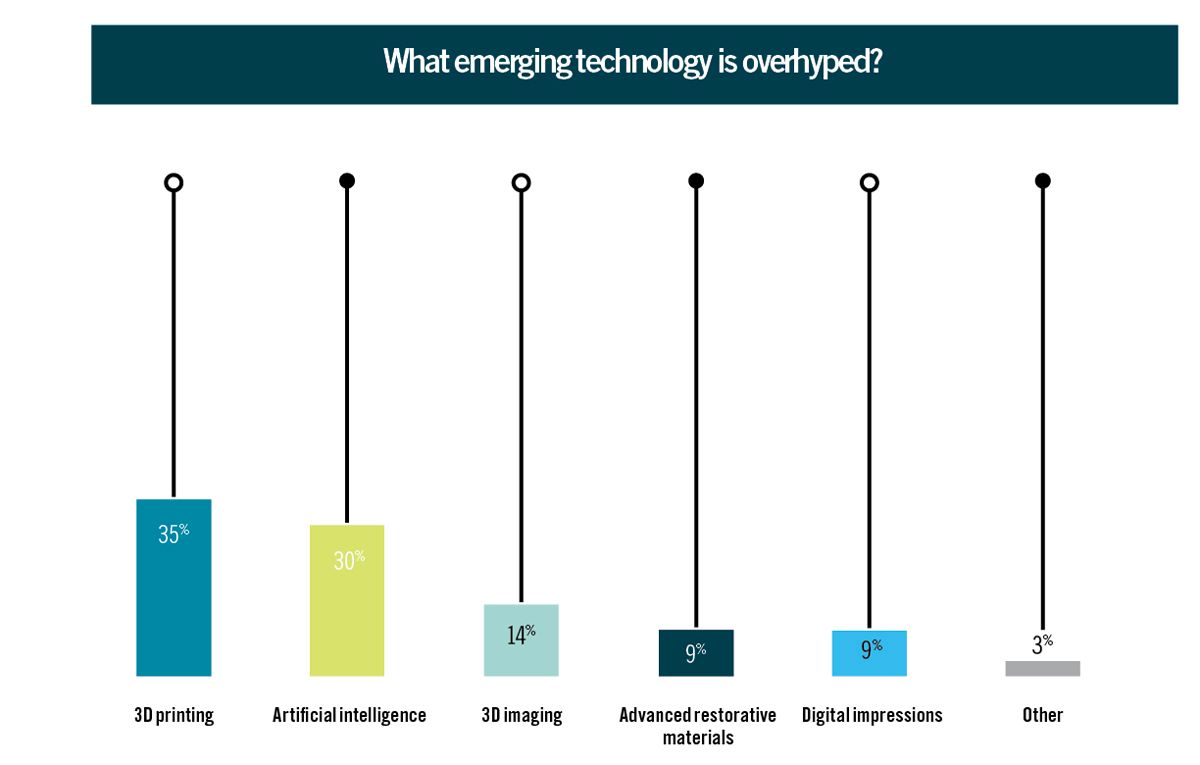

[ Worth the Hype?]

Respondents were split on what technologies were overhyped in the dental industry. Although 35% agreed that 3D printing may be overhyped, about 30% made the same claim for artificial intelligence. It can be difficult to come to a consensus on whether a technology is indeed overhyped, as some practitioners may find these systems work for their practice and others may not. Time will tell if these products live up to the claims or if they fall flat.

If money were not a factor, what technology would you add to your practice and why?

This open-ended question gave respondents the opportunity to voice their thoughts on what technologies would be worth another look if they didn’t have to worry about a steep price tag. Popular answers here included artificial intelligence for a second opinion to help doctors, CBCT systems for digital imaging capabilities, and CAD/CAM for in-office manufacturing. Lasers were also a popular answer, both soft- and all-tissue.