Where Student Debt is the Best and Worst for Dentists

Dental School graduates face some of the highest levels of debt post-graduation, a factor that should impact where they decide to live and work after school.

After Dental School you'll most likely be carrying student debt for quite some time, making it important to not only figure out how to live with it but where to live with it.

Student loans change lives. They provide incredible opportunities for millions of students. At the same time, small ones are nothing to scoff at and big ones can delay major life milestones by months, years, or even decades. With that in mind, recent graduates must factor their loans into decisions about where to live and work. This is especially true for dentists, as they are number 4 in the top 5 most debt heavy graduates with an 11.5% monthly debt-to-income ratio.

According to Wallethub, a personal finance site powered by expert studies, outside of mortgages, student loans make up one of the largest components of debt in American households. So, suffice it to say, there’s no way to avoid paying off your loans if you’ve accrued them, and the best you can do is find a way to successfully manage student debt by making strategic decisions about where and how to live.

Wallethub recently conducted a study detailing the best and worst states to live in with student debt. We here at Dentist’s Money Digest rounded up the key information from that study, as well as the five states with the least amount of student debt.

The Study’s Methodology

Wallethub compared two dimensions for all 50 states, “Student-Loan Indebtedness” and “Grant and Student work opportunities”. These were made up using different metrics specific to each category. For example, to calculate “Student-Loan Indebtedness” they measured average student debt, proportion of students with debt, student debt as share of income, share of student loans in past-due or default status, and share of student-loan borrowers aged 50 & older.

Under “Grant and Student Work Opportunities” the metrics used were unemployment rate among population aged 25 to 34, underemployment rate, availability of student jobs, availability of paid internships, grant growth, and presence of “Student Loan Ombudsmen” law. For both metrics a score of 1-100 was given, 100 being reserved for the states with the most student debt, and then the weighted average from all metrics was taken to craft the overall scores states received.

Extra weight was given to some metric’s points, like proportion of students with debt, student debt as share of income, share of student-loan borrowers, and unemployment rate among population aged 25 to 34.

The Rankings

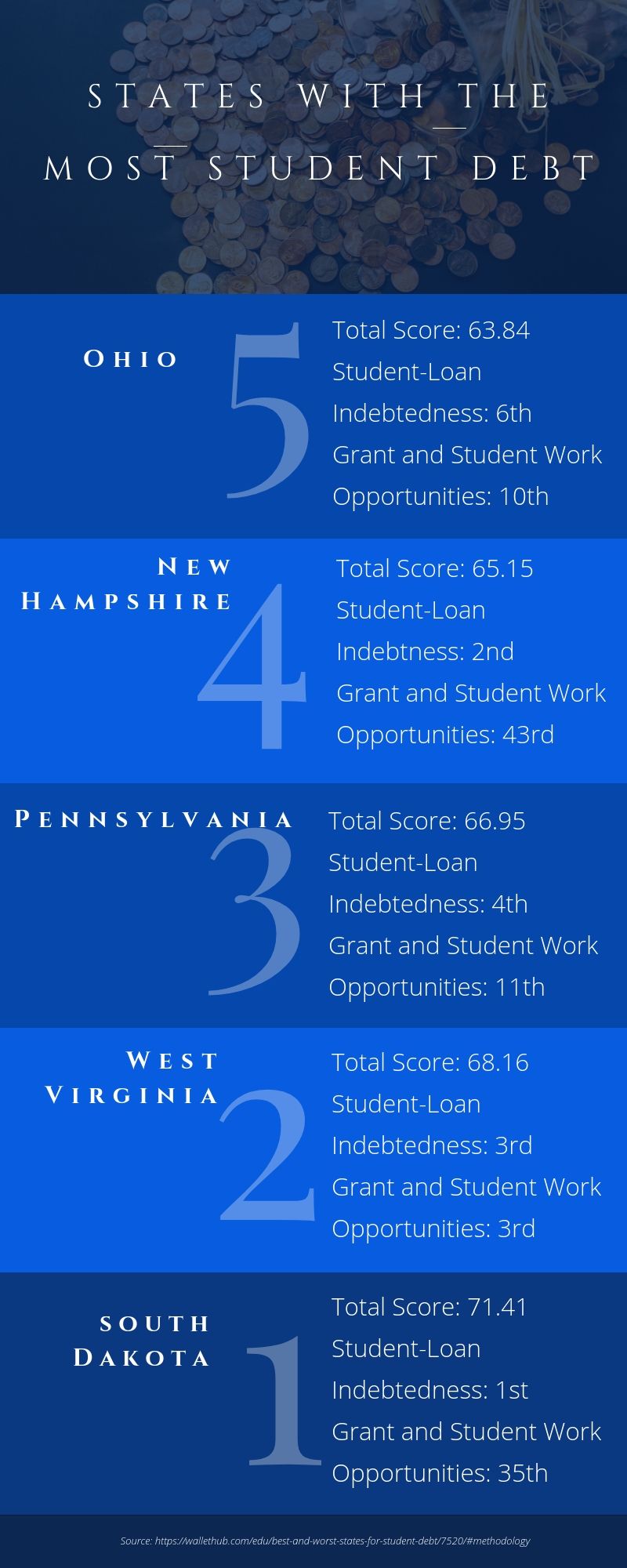

After all the calculations the rankings for each state may surprise you. Below, you can take a look at the top 5 states with the most student debt.

The states that came in with the least amount of student debt were Utah, total score of 13.77, Hawaii, total score of 15.60, Wyoming, total score of 24.66, California, total score of 25.22, and Washington, with a total score of 30.18. It is important to note that while the states with the most student debt all ranked in the top 10 of student-loan indebtedness, West Virginia and Ohio both made it in the top ten of states with the best “Grant and Student Work Opportunities”.

Key Takeaways

Aside from the rankings, the data collected revealed some interesting findings that can also help a recent graduate decide where to live and work right after school. For instance, the state with the lowest student debt as a percentage of their income, which was adjusted for the cost of living in each state, was Maryland, which ranked 43rd on the overall list. It is also important to note that while Utah was ranked with the least amount of student debt, they only came in at 29th when it comes to “Grant and Student Work Opportunities”.

Of course, your situation is your own and unique to you. There are other factors to consider when finding the best place to live, but your students loans will follow you wherever you go. Make sure to take the time and research which state will ultimately have the best opportunities for you to chip away at your debt.

Related Articles

- 5 Things to Consider When Opening a New Savings Account

- What Losing the Public Service Loan Forgiveness Program Might Mean for You

ACTIVA BioACTIVE Bulk Flow Marks Pulpdent’s First Major Product Release in 4 Years

December 12th 2024Next-generation bulk-fill dental restorative raises the standard of care for bulk-fill procedures by providing natural remineralization support, while also overcoming current bulk-fill limitations.