The Impossible Dream? How to Bring Your Retirement Goals Within Reach

When it comes to retirement savings, millennials seem to be of two minds. So, do they have a chance at successfully saving an adequate amount for retirement?

Millennials are an interesting bunch. Just a few weeks ago, we learned that 71% of millennial investors predict a bull market in the next one to three years, compared to only half of boomers who share that confidence. And research shows that millennials are ready to seize the day with their savings and investing strategies.

Yet, a recent study by Wells Fargo suggests that those same prepared folks consider the goal of having $1 million in retirement savings “impossible.” What gives? Is this a confident, emerging generation? Or one that feels woefully inadequate when it comes to preparing for their future?

The truth is likely somewhere in the middle. But for now, let’s take a closer look at the “impossible.”

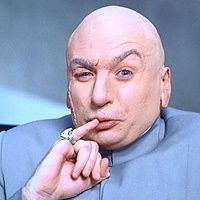

“One million dollars.”

There’s a running gag in the classic spoof Austin Powers: International Man of Mystery. Dr. Evil, played hilariously by Mike Myers, is defrosted after being cryogenically frozen for decades. He hatches a plan to kidnap and ransom world leaders, unless he’s paid the exorbitant sum of “one meeeelllion dollars.” Assorted henchmen get a good chuckle at the good Doctor’s failure to keep his price more in line with today’s exorbitance.

The same can be said for today’s young retirement savers. $1 million is a good solid round number. It’s easy to remember, and it sounds like a lot of money. But the truth is that the amount is arbitrary and doesn’t really reflect inflation, cost increases in big categories like healthcare, and the fact that average life expectancy has increased significantly since the 1960s. Today, a goal of $1 million may not be enough.

Where is that panic button?

So, if millennials are panicking about generating a level of income that may, in fact, not be sufficient for their retirement needs, then it must really be time to hit the panic button, right? Not so fast. First of all, the Wells Fargo study illustrates a very unsurprising concept: retirement savers’ biggest fear is not saving enough for retirement. The survey methodology was also weighted toward those earning significantly less than dentists typically earn.

Still, the numbers are jarring, and even dentists share the fear of not having enough to retire on. If you find yourself sharing this fear, take a few simple steps now.

1. Start investing. If you’ve already started, invest more. Virtually no matter what you invest in, you’ll be better served by starting as early as possible.

2. Invest for the long-term. Investors who lack confidence are more likely to do things that inspire…a lack of confidence. Short-term starts and stops in investment vehicles are more likely to harm the overall performance of your portfolio than an established, longer term investment window. Find a strategy that works for you, and stick to that strategy.

3. Set some short-term goals. We’ve written often of the psychological impact of trying to reach far-off goals with small, incremental steps. The payoffs often aren’t big enough to seem worth it. Which is part of the reason a Dr. Evil-sized goal may seem out of reach. Break it into smaller increments, and the marathon of lifetime investing can seem much more attainable.

ACTIVA BioACTIVE Bulk Flow Marks Pulpdent’s First Major Product Release in 4 Years

December 12th 2024Next-generation bulk-fill dental restorative raises the standard of care for bulk-fill procedures by providing natural remineralization support, while also overcoming current bulk-fill limitations.