The Endowment Effect: The Role of Loss-Aversion and Ownership in Making Financial Decisions

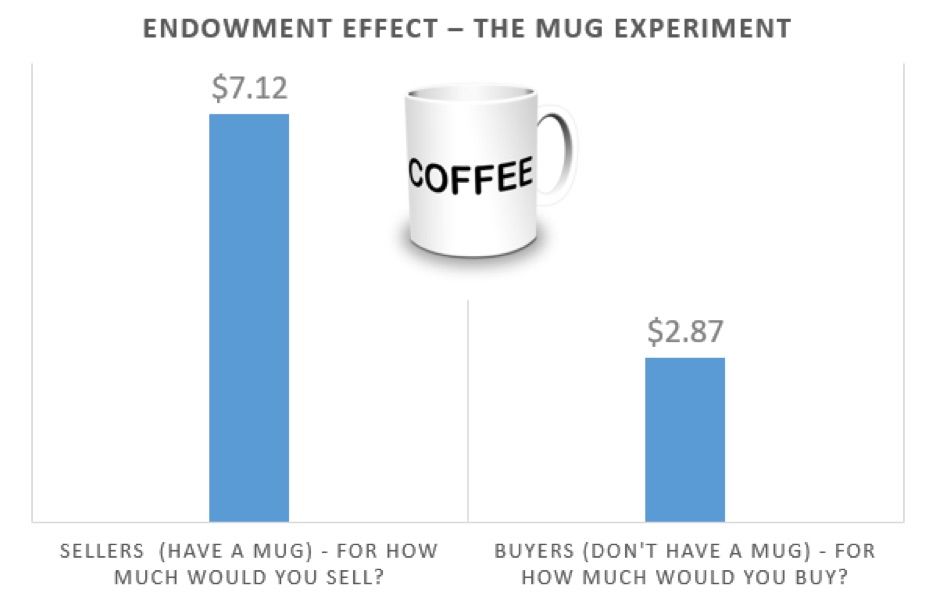

"If it's mine, it's worth more; if it's yours; it's worth less." This is called the Endowment Effect - irrational thinking that plays a part in our daily decisions.

If it’s mine, it’s worth more; if it’s yours; it’s worth less. This is the Endowment Effect, a cognitive bias by which we value something we own more than an equivalent item which belongs to someone else. This kind of thinking is irrational yet it plays out daily in decisions.

For example, if we possess a piece of chocolate cake, we might sell it for $6.00. But if we were buying it from someone else, that $6.00 would be too high for us to fork out. As a buyer, we might consider paying $4.00 or less.

Daniel Kahneman, Jack L. Knetsch and Richard H. Thaler (the 2017 winner of The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2017) use another variety of dessert in their classic experiment demonstrating the same point with chocolate bars. The paper “The Endowment Effect, Loss Aversion, and Status Quo Bias,” was published in The Journal of Economic Perspectives.

From “Endowment Effect: A Guide to The Emotional Trigger That Influences Your Customers’ Minds,” by Tomer Hochma.

In the experiment, participants are given objects of similar value to use for exchange in place of currency. Some receive a chocolate bar which is equivalent in price to a coffee cup given to the others. Those with the cup are reluctant to exchange it for the chocolate bar and vice versa. This indicates human propensity to value what we own over that which we do not.

This kind of irrational behavior applies to other financial situations as well. For example, let’s say Dentist A owns a colonial home. If Dentist A were to sell it, she would expect a higher price than if she were to buy a nearly identical house on the open market. The doctor is partial toward what she owns.

Although economists originally hypothesized that the endowment effect occurrs because humans are loss-averse, new evidence suggests there is an additional reason under specific circumstances. We identify with something that we bestow ownership on.

Sara Loughran Dommer and Vanitha Swaminathan’s 2012 experiment demonstrates the point. Dommer is an assistant professor of marketing at the College of Management, Georgia Institute of Technology in Atlanta and Swaminathan is on the faculty of the University of Pittsburgh.

The two asked undergraduate students to role-play regarding a ball point pen transaction. Those designated as sellers were given pens and asked if they wished to keep the pen or sell it for a cash amount—between $0.25 and $10.00. Those selected as buyers were asked to decide if they wanted the pen or a cash amount in the same range.

Before the experiment began, some of the undergraduates were asked to imagine a past relationship when they felt unloved and write down their feelings related to it. The others were requested to write about an average day.

Students sellers who contemplated rejection valued their pens more than those who did not. The authors concluded, "After a social self-threat, individuals likely have strong possession-self links because possessions can enhance the self and help individuals cope with the threat."

Dommer and Swaminathan did not discard loss-aversion as a reason for the endowment effect, but they did suggest that their ownership hypothesis is another explanation. Indeed, the emotion behind financial decisions is complicated!