The latest revenue data for dental practices across the nation

This article will discuss national trends such as average gross revenue and collections in private dental practices, focusing on the widening gap between the revenue due and the actual dollar amount that is collected by the practice for services and products.

Dentists managing patient care across the nation are also often faced with a second task: Managing finances. Understanding the meaning behind the numbers and making managerial decisions can be challenging and time-consuming.

This article will discuss national trends such as average gross revenue and collections in private dental practices, focusing on the widening gap between the revenue due and the actual dollar amount that is collected by the practice for services and products.

Sikka Software collects data from thousands of practices across the United States. Data is HIPAA and HITECH compliant and is free of any practice or patient information. The data allows unprecedented insight into private practice for benchmarking. Dentists can learn more about growing their revenue and managing collections by visiting www.sikkasoftware.com.

Related reading: The latest fee data for 18 popular procedure codes

Gross revenue

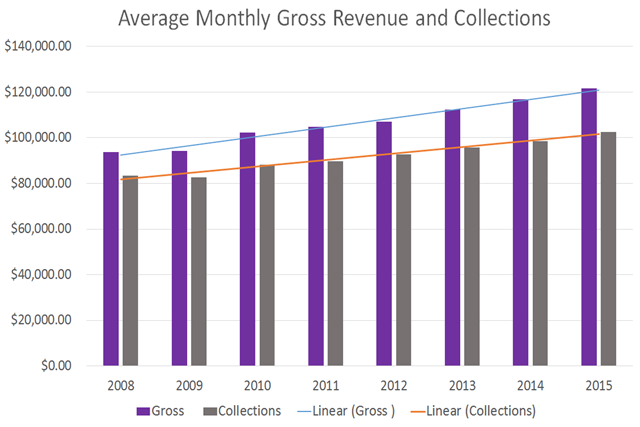

Dentists have enjoyed an increase in revenue over the previous eight years. This is likely a reflection of increase in care costs, as well as general dentists developing new skills to bring in new avenues of revenue. In 2008, the average monthly revenue for a practice was $93,817 with an average collection of $83,356.88. By contrast, in 2015, the average monthly revenue was $121,546.21 with an average collection of $102,542.79.

This may appear positive, however a concerning trend has developed: Dentists are collecting a smaller percentage of their gross revenue, indicating that hard work is not always resulting in reward.

Related reading: Let's talk about money: The 2014 dental fee survey

Continue to the next page to see the numbers for collections as a percentage of gross revenue...

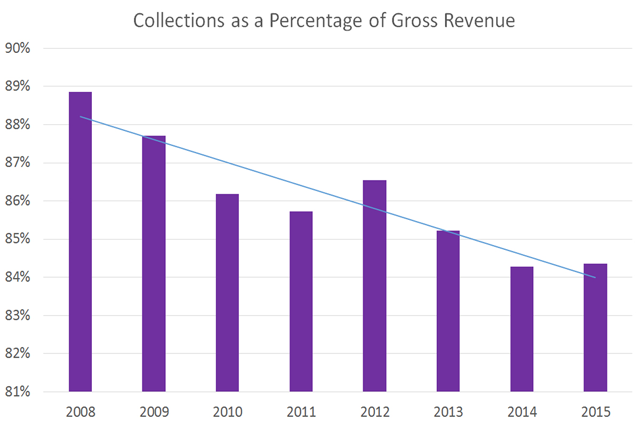

Collections as a percentage of gross revenue

Despite strong performance in revenue and an increase in collections, dentists are not reaping the benefit of their hard work. The percentage of revenue that remains uncollected has grown. In 2008, dentists collected 89 percent of revenue. By comparison, in 2015, dentists collected an average of 84 percent. There are two potential causes for this shift. The first is that, in an increasingly competitive environment, dentists have adapted payment policies to reflect more adjustments, including discounting. These adjustments may appear minor and may even be necessary for bringing in revenue, but they can also eat away at profit margins.

The second possible cause of this trend is increased challenges in collections. It can be uncomfortable to ask for money, however, the more time that passes prior to collections, the less likely dentists are to be paid. Collections where large periods of time between treatment and payment often results in no payment at all. The more time spent on collecting from older accounts means that labor cuts into your profit margin.

The solution is two-fold. First, dentists need to monitor their fees so they are set competitively for their area, decreasing the need for adjustments. By keeping on trend, dentists will need to make fewer adjustments moment-to-moment to say competitive. Second, dentists must find an accounts receivable solution that works for their practice and their team. The key to collections is keeping the conversation current and preventing time elapsing prior to asking for collections. Finding a solution to ask for timely payment is key, while maintaining the doctor patient relationship.

More from Sikka Software: Exploring average patient cost per practice

More from Sikka Software: The most current trends in dental implant popularity and revenue

Conclusion

Data is a powerful tool for understanding dental practices and setting goals for how to grow revenue while maintaining excellent patient care. The topic of money is particularly challenging, as financial discussions may upset the relationship between doctor and patient and disrupt future interactions. That is why understanding the practices fees and financial policies, as well as the impactions of these policies on the bottom line, is imperative to practice health. Making these assessments requires numbers, as well as benchmarking against national trends, to understand how your practice operates and areas of potential growth.

Dentists can learn more about how to track their own numbers, set fees based on zip code data and benchmark and set growth goals at https://www.sikkasoft.com/apps-for-healthcare/dental/.

Episode 31: Dentsply Sirona Implant Announcements

September 30th 2021DPR’s Editorial Director Noah Levine sat down with Gene Dorff, Dentsply Sirona’s group vice president of implants and Dr. Dan Butterman to review several big announcements the company made in the arena of implants during Dentsply Sirona World 2021 in Las Vegas.

Oral Health Pavilion at HLTH 2024 Highlighted Links Between Dental and General Health

November 4th 2024At HLTH 2024, CareQuest, Colgate-Palmolive, Henry Schein, and PDS Health launched an Oral Health Pavilion to showcase how integrating oral and general health can improve patient outcomes and reduce costs.