How basic estate planning protects individuals and legacy: Part 2

Estate planning can help you protect and care for yourself, your family and your practice.

Once the key estate planning documents are established, it is important to outline the roles and responsibilities of the individuals named to serve in those documents.

This second part of this series on the basics of estate planning will cover those roles and responsibilities associated with the documents, which include a will, a power of attorney, a healthcare power of attorney, and a living will. The article also will look at how an account or an asset is titled, what types of assets have beneficiary designations, and why it is important to ensure that those you name on those designations are consistent with the overall estate strategy.

Each estate planning document requires that you name someone to help you either during your lifetime or at death. The key people to name include:

- Executor

- Guardian

- Agent (DPOA)

- Agent (Healthcare)

- Trustee

Read more: How basic estate planning protects individual and legacy: Part 1

Estate planning roles

One of the most important decisions in estate planning is picking the person, or people, who will be in charge of your assets and legally obligated to act in your interest. The task of each of these individuals is slightly different. It is recommended to name more than one alternate for each role, but you may also name two persons to act together, such as co-trustees or co-executors.

Executor

An executor is someone who carries out the directions in the will. The executor is sometimes referred to as “personal representative” for this role. If you leave no will and your estate is managed by the probate court, this role is sometimes referred to as “administrator.”

This person is responsible for collecting the assets of the estate, protecting estate property, preparing an inventory of the property, paying valid claims against the estate (including taxes), representing the estate in claims against others, and distributing the estate property to the beneficiaries. It is important to know that the executor only controls property or assets that are subject to probate.

Guardian

If a minor child is involved, a guardian needs to be appointed to raise the child in the event both parents die before the child becomes an adult. While the likelihood of this happening is slim, the consequences of not naming a guardian are great. If a guardian is not named, a judge will decide who will raise the child.

This is an important role to revisit over time. For example, early in the child’s life you might name a parent or grandparent as guardian. As the toddler becomes a teenager, it may be wiser to name a sibling (who is closer in age to you) rather than an aging parent or grandparent.

Agent (DPOA)

In a power of attorney, you give authorization to a certain person, or people, to make decisions on your behalf when you are not physically or mentally capable. This person is known as an Agent. Realize that this document and person have control only during one’s lifetime. The power terminates at death, when the will or trust instructions become effective.

This is an important document to avoid court intervention at a stressful time. Imagine that you don’t have this document and are severely injured. On top of the health concerns, your family may need to deal with court appearances to manage your finances or make certain financial decisions on your behalf.

Continue to page two to read more...

Agent (Healthcare)

Deciding who will be named as your healthcare agent is one of the more difficult and important decisions in estate planning. The healthcare agent receives a durable power of attorney for healthcare from you, which gives your agent the power to make medical decisions if you are incapacitated or unable to make medical decisions.

The healthcare agent cannot override any health care preferences you set out in a living will, but will have complete authority to make any other medical decisions. If you have strong feelings about your health care, this is the place to specifically express them.

Trending article: What a paperless practice really looks like

Trustee

If you create a revocable living trust, you will name a trustee, or co-trustees, to manage your assets. Realize that the trustee will control those assets that are in the trust. He or she will manage that property as directed in the trust.

If your trust directs that the trustee ensure all bills are paid, all debts owed to you are collected, and all assets are distributed in a timely fashion, the trust will end fairly soon after your death.

On the other hand, you may want your trust to endure for years or decades. This allows you to control how assets are managed and distributed over time. Perhaps you have a spend-thrift or minor child who you want to provide income over time. In this case, the trustee will serve for the time period you direct in your trust.

Asset titling, beneficiary designations

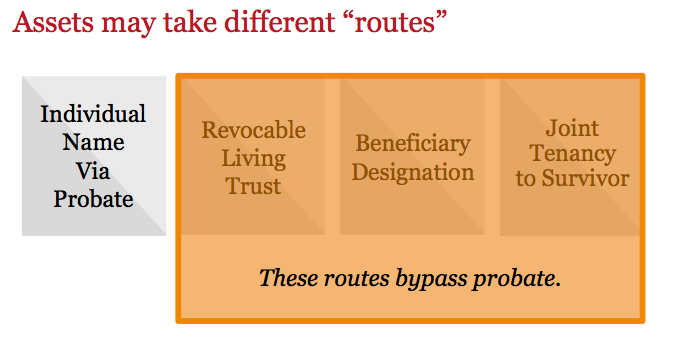

Earlier the importance of retiling assets was discussed, especially if you establish a trust. Let’s take a closer look at account titling and beneficiary designations. You can liken these topics to off ramps on an interstate highway. Depending on how assets are titled or beneficiaries designated, assets can go different directions at your death.

For example, assets titled in your name alone are governed by your will and go through probate. Assets in a trust or held in joint tenancy will bypass probate. Neither direction is right or wrong, but one or another may be more suitable for you. You should discuss these possibilities with your attorney.

Let’s take a closer look at how titling matters, starting with assets in one’s individual name. The executor will control these assets, and he or she will follow the directions in the will. The assets will be distributed at the conclusion of the probate process.

Assets in a revocable trust are controlled by the trustee or successor trustee. The trust document provides instructions, and they will be distributed or managed according to the terms in the trust.

Related reading: Transitioning a dental practice after death

A beneficiary designation acts differently. This is a contract between an individual and the financial institution, and the terms of that contract “trump” everything else - even what the will or trust instructs. The beneficiary will file a claim, and the financial institution will distribute the asset. No probate. No governance by a will or trust instructions.

Finally, when an account jointly is titled with someone, such as a son or daughter, the son or daughter owns that asset at your death. That outcome may be a mistake.

If your intent was that the son or daughter would divide the value of that asset among siblings, that may or may not happen. Even if it does, it could have gift tax consequences for that child.

Or perhaps, you become incapacitated and the other owner wants or needs to move the account. The financial institution may require the signatures of both owners to do so. Discuss these implications with your attorney before deciding whether joint tenancy is the best way to achieve your goals.

Assets with beneficiary designations

Assets with beneficiary designation are life insurance policies, annuities, IRAs, other retirement plans, and Transfer on Death accounts. Other benefit plans that have a beneficiary include work benefits, stock options, or stock purchase plans. Remember, review beneficiary designations as the family situation changes, and be sure to update them every three to five years, or whenever your circumstances change.

Editor’s Note: This article is the second part of a two-part series on the basics of estate planning. This article addressed the roles and responsibilities of individuals involved in estate planning and the types of assets associated with beneficiary designations. To review the first part of this two-part series, see “Basic estate planning protects individual, legacy;” page 44, Nov. 15 issue of Ophthalmology Times, or online here.