Economists Say Presidential Election Could Have Big Impact on Home Prices

If Donald Trump or Bernie Sanders wins the presidency, economists say housing prices could be headed in a negative direction.

Planning to sell your home? You may want to do so before the November election.

Zillow, the real estate listing and research site, says the election could have a major impact on the housing market. Their finding is based on a survey of more than 100 economists.

If presumptive Republican nominee Donald Trump wins the presidency, the economists expect a downturn in the housing market, as well as the overall economy. If leading Democratic candidate Hillary Clinton wins, the economists believe housing prices will rise, though the overall economic impact will be neutral.

“As the presidential election nears, candidates’ individual plans for the economy are increasingly under scrutiny,” said Svenja Gudell, PhD, Zillow’s chief economist. “Many of the candidates’ proposals sound appealing to voters, but a closer look through the panelists’ economic lens reveals the potential impact of those proposed policies on our economy.”

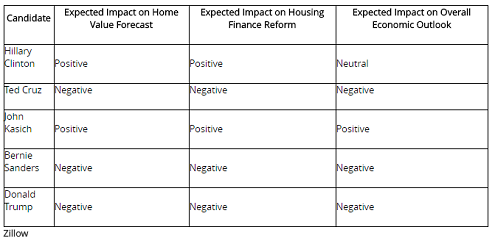

Gudell said the economists surveyed tended to favor candidates with more centrist approaches. Economists were asked to predict whether a given candidate’s election would have a positive, neutral, or negative impact on three economic factors: home values, housing finance reform, and overall economic outlook.

The survey was conducted in late April and early May, prior to the winnowing of the GOP field, so the survey questions also included former Republican contenders Sen. Ted Cruz and Gov. John Kasich, as well as Democratic candidate Sen. Bernie Sanders.

Kasich was the only one of the five candidates whose election was expected to have positive impacts in all three areas. Trump, Cruz, and Sanders were expected to have negative impacts in all three categories.

Regardless of who wins, the survey panel voiced underlying concerns about the strength of the housing market and overall economy. Half of the respondents cited low inventory as the chief cause of recent increases in housing prices, rather than wage growth or low mortgage interest rates. Zillow also reported that nearly two-thirds of those surveyed disagreed with the Fed’s recent decisions to keep interest rates near historic lows.

The survey was sponsored by Zillow and carried out by Pulsenomics LLC, an independent research and consulting firm.

Pulsenomics Founder Terry Loebs said overall the experts expect home values to trend slightly downward in the longer-term.

“After adjusting for expected inflation, the expert panel’s forecast for national home value appreciation averages 1.7% annually through 2020,” Loebs said.

That’s about half the rate experienced since the economic recovery started in 2012, Zillow noted. However, Loebs pointed out that 1.7% annual growth would still outpace the “relatively normal” period prior to the pre-recession bubble. During that pre-recession period, home values lagged behind the rate of inflation.