Dentists Among Highest Student Loan Monthly Debt-to-Income Ratio

Dentists graduate with tremendous debt. Education around student loan repayment programs, loan forgiveness, and career path planning can help.

Student debt plagues just about every person with a graduate degree. The healthcare industry is no different with debt weighing down every graduate from vets to medical assistants.

Dentists are not immune to the cost of funding their education.

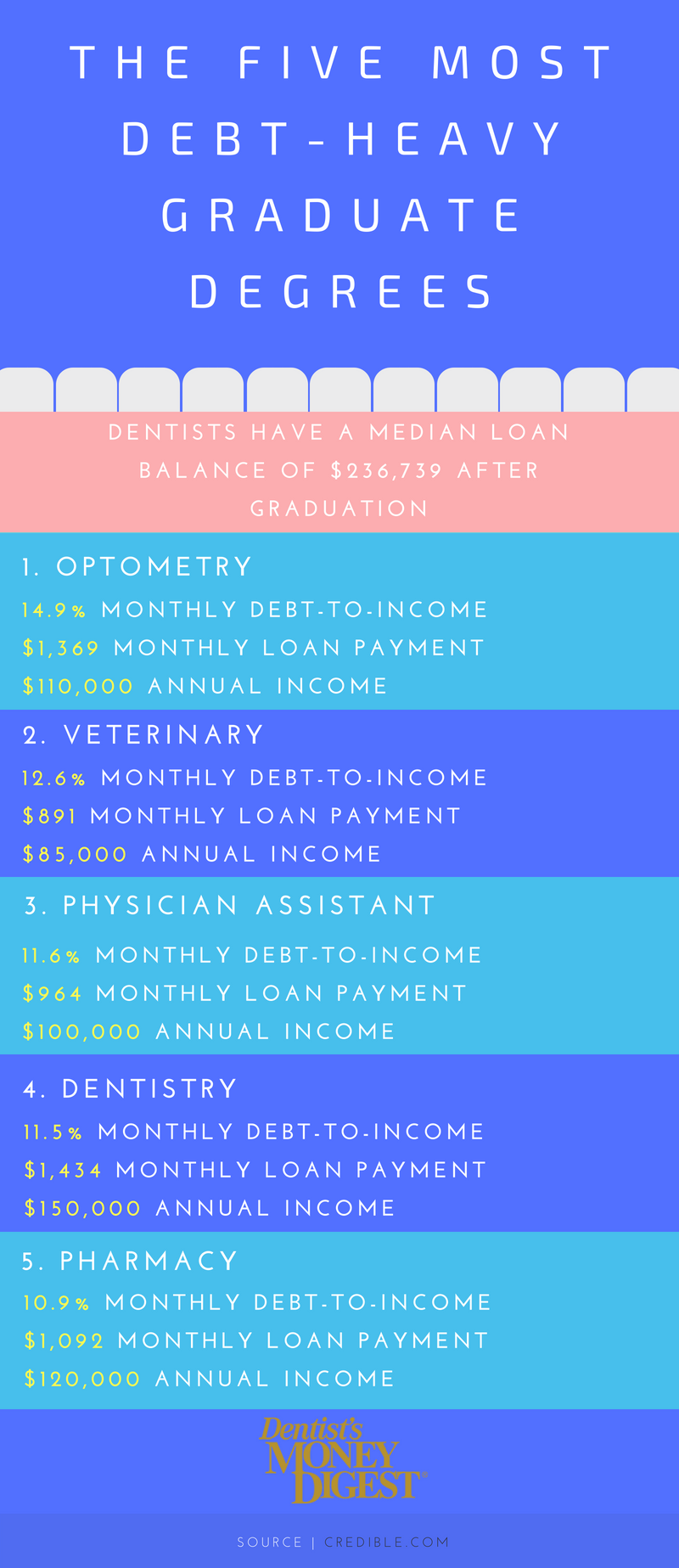

According to a recent analysis of 91,000 graduate degree holders dentists rank among the top five of highest monthly debt-to-income ratio.

Dentists take the number four spot for the worst debt-to-income ratio according the Credible’s study with over 10% of their monthly income going towards debt repayment.

Currently, dentistry has the second-longest repayment outlook with nearly 15 years of repayment facing new dentists after graduation. Veterinarians, pharmacists, and healthcare admins are not far behind.

Here is a look at the top five professions with the highest debt-to-income ratio.

The lack of balance in between income and outgoing student debt repayments could mean students may look to lower their payments by spreading them out over many years. However, this tactic will only add more money to the loan balance as interest builds.

The earlier dentists, and other graduates, examine their post-graduate options, the better prepared they will be for the first few months and years of their career.

Solutions

Education

Students, as early as high school, should participate in financial planning courses. Sometimes the salary of the job they are studying to achieve masks the reality of the cost it will take to get there.

Preparation for those first few years out of graduate school can help students better prepare to save where and while they can.

Dental students especially are looking at an unsustainable ratio with a median loan balance of $236,739 and a median income of about $150,000. The latter number can change depending on where they live, how quickly they can gain employment after graduation.

“There’s been progress in providing access to information about what college will actually cost,” says Stephen Dash, founder and CEO of Credible. “But we need more transparency to help students get a handle on what they will earn after graduation, and how much debt those earnings will support.”

- For more on success after graduation: Networking is Key for Dental Graduates

The ADA offers a few financial planning resources including a pamphlet on common issues facing dental graduates. Included in the pamphlet are contacts for free student loan contract analysis services, professional success financial calculators, and new dentist representatives for student members.

Repayment Programs

There is relief for some practitioners. Student repayment programs can ease the burden of high interest repayment programs. Additionally, some graduates may qualify for student loan forgiveness plans.

Taking jobs in underserved areas, state-by-state programs exist, but they all come with their own rules and qualifications.

- For more on student loan forgiveness plans: Dental School Loan Forgiveness Programs

But be advised, it is extremely important to do your homework. Scams are common masking behind the guise of federal agencies offering consolidation programs. The Federal Student Aid website has a website dedicated to scam programs. When in doubt, do your due diligence and get in contact with as many people as possible.

While the reality of student debt appears intimidating on the surface, pursuing a career serving others, especially one that you are passionate about will pay off. Just remember to keep payments on time, focus your attention to post-graduate life early, and you’ll set yourself up for financial success down the road.

ACTIVA BioACTIVE Bulk Flow Marks Pulpdent’s First Major Product Release in 4 Years

December 12th 2024Next-generation bulk-fill dental restorative raises the standard of care for bulk-fill procedures by providing natural remineralization support, while also overcoming current bulk-fill limitations.